Ghana’s housing gap widens

GHANA is grappling with a critical housing crisis, as the country’s housing deficit has surged to 1.8 million homes.

This massive shortfall translates into millions of Ghanaians being unhoused or struggling to find decent living spaces.

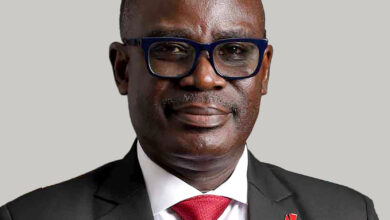

According to Eric Eduam, Chief Executive Officer of WalterEduam Limited, the situation is alarming, especially when compared to developed economies, where such housing gaps are significantly smaller.

He highlighted that the deficit leaves many Ghanaians seeking opportunities for secure and adequate accommodation, a challenge that has become increasingly pressing as the population grows.

Eduam also noted a shift in how people approach homeownership in Ghana. Traditionally, the process involved purchasing a piece of land and enduring the often complicated and lengthy process of building a home from scratch. However, in recent years, more Ghanaians are opting to buy pre-built homes from real estate developers.

“The trend now,” Eduam said, “is that estate developers are producing completed houses ready to be bought and occupied by homeowners. This new wave of property acquisition is gaining traction, but both options—building or buying—come with their own set of challenges and benefits.”

Eduam explained that while purchasing a pre-built home offers convenience, it may not necessarily be affordable for everyone. For many Ghanaians, buying a ready-made home involves higher upfront costs, which may be out of reach for those with limited financial means.

Nonetheless, it provides an attractive alternative for people who want to avoid the time-consuming and often stressful process of managing a construction project.

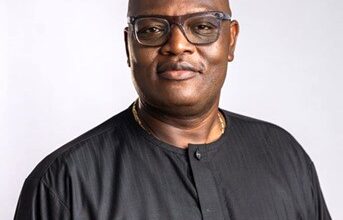

In contrast, Patrick Thompson, Project Coordinator of Sterge Limited, emphasized that many Ghanaians still prefer the traditional route of building their homes at their own pace.

Speaking on the Zed Roundtable, Thompson explained that building a home incrementally allows homeowners to control costs and spread out their financial commitments over time.

“Due to certain factors and reasons, people are leaning more towards building their own homes,” he said. “At their own pace, in their own time, as against buying from estate developers.”

The cost factor is a significant driver of this preference. Thompson pointed out that the initial investment required to purchase land and begin construction is often lower than buying a completed house.

“For obvious reasons, money matters,” Thompson added. “You have to look at your budget—how much you have available to start your project from scratch. Bearing in mind that you have to procure land and then factor in construction costs, building from scratch can sometimes help save more in the long run.”

However, building a home from scratch also comes with its own set of challenges, including the hassle of acquiring land in prime locations, dealing with contractors, and managing rising construction costs.

Many people are forced to contend with delays and unexpected expenses that can stretch their resources thin over time. Yet, for some, the ability to customize their home and the flexibility of spreading payments outweigh the drawbacks.

Eduam and Thompson’s perspectives underscore the complex nature of Ghana’s housing market, where both building and buying have their own merits.

Eduam believes that the trend towards purchasing ready-built homes will continue to grow as the real estate sector expands and more Ghanaians seek convenience and faster access to accommodation.

On the other hand, Thompson argues that for those on tighter budgets, building from scratch remains a viable option, offering more control over costs and allowing homeowners to build at their own pace.

With Ghana’s population nearing 30 million and demand for housing increasing, both options will continue to play critical roles in addressing the housing crisis. However, experts agree that deeper policy interventions are needed to close the housing gap.

Affordable housing schemes, government incentives for first-time homebuyers, and reforms in land acquisition processes could help alleviate the challenges that individuals face in securing decent homes.

Without such measures, the housing deficit will likely continue to grow, exacerbating the plight of millions of Ghanaians looking for a place to call home.