‘Financial services sector needs overhaul for better integration’

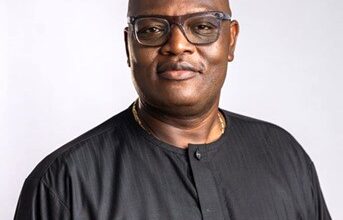

Advisory Board Chair of Financial Literacy Africa, Mr. Richard Kwame Frimpong has noted significant structural challenges within the African financial services sector, emphasizing the need for a more integrated and coordinated approach to regulation and financial literacy.

Speaking at the 13th Ghana Economic Forum, Mr. Frimpong pointed out that the current structure of the financial services sector across the continent is fragmented, with regulatory bodies operating in silos.

“If you pick the universe of financial services, there is banking, there are pensions, there is insurance, and there are investments. The structure is such that regulation is literally sitting in silos,” he explained.

The disjointed regulatory framework, according to Mr Frimpong, hampers the effective mobilization of domestic savings, which is crucial for powering the funding side of industrialization efforts.

He echoed earlier sentiments by Abena Amoah, Managing Director of the Ghana Stock Exchange, about the importance of domestic involvement in economic development. “We need to be deliberate about the synchronization of the structures that overlook the entire financial services sector,” Frimpong urged. He called for the establishment of a “super structure”—a national financial services authority—that could coordinate where domestic savings sit within the financial ecosystem and ensure these funds are efficiently utilized to support economic growth.

Frimpong also highlighted the need for improved financial literacy, noting that a lack of understanding among the populace is a significant barrier to financial inclusion and economic empowerment. “As we speak, if you pick every 10 Ghanaians, you are likely to find only two who are financially literate enough to appreciate the difference between a banking product, an insurance product, a pension product, and even an investment product,” he lamented. This gap in financial literacy, he argued, exacerbates the challenges within the financial ecosystem, where many have yet to fully grasp the importance of financial independence and wealth creation.

Frimpong’s remarks underscore the urgency of rethinking the structure and regulation of Africa’s financial services sector. By creating a more harmonized regulatory framework and improving financial literacy, he believes the continent can better harness domestic savings and promote sustainable economic development.