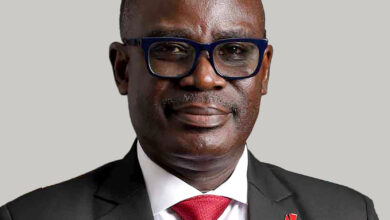

Ecobank Group CEO outlines strategic focus for Africa’s banking sector

Ahead of the Africa Financial Summit, Jeremy Awori, CEO of Ecobank Transnational Incorporated (ETI), has outlined strategies to address the challenges and opportunities facing Africa’s banking sector. Speaking in a video interview, Awori emphasized Ecobank’s commitment to fostering financial inclusion, driving SME growth, and leading in payment solutions across the continent.

Expanding Core Banking Services

Awori highlighted the bank’s core focus on corporate investment banking, which remains a vital growth driver. “We’re investing in areas like cash management, trade finance, and payments while continuing to provide syndications and lending facilities,” he said. The bank sees enormous potential to develop products and services that cater to the rapidly growing financially included population across Africa.

Empowering SMEs

Small and Medium Enterprises (SMEs) are pivotal to Africa’s economic development, and Ecobank aims to empower these businesses to transition into larger corporates. “SMEs are the engine of growth in most African economies. We are building tailored propositions and solutions to help them grow and succeed,” Awori noted. The bank is leveraging its ecosystem to connect big corporates with SMEs, suppliers, distributors, and employees, creating a seamless value chain.

Leadership in Payments and Digital Solutions

A key area of focus for Ecobank is its payments business, where the bank is aiming to establish itself as a continental leader. Awori emphasized the unique capabilities of Ecobank in enabling real-time, cross-border payments in local currencies. “We’re the only bank that can facilitate instant digital payments across African countries, from Kwacha to Shilling or Shilling to Cedis,” he said.

To expand this business, Ecobank is forming strategic partnerships with telecom companies, fintech firms, and other banks. The bank is also aggressively entering the remittance space to streamline diaspora inflows and foreign direct investments. Awori cited a recent partnership with Neom and Transfer2, which enables remittance flows from over 200 countries into Africa.

The Role of Partnerships

Awori underscored the importance of collaboration in achieving Ecobank’s vision. “To lead in domestic payments and remittance, partnerships with telcos, fintechs, and remittance players are critical,” he said. These partnerships aim to simplify money transfers, encourage investments, and drive economic growth across the continent.

Driving Africa’s Banking Future

Awori’s insights reflect Ecobank’s dedication to becoming a cornerstone of Africa’s financial ecosystem. By addressing gaps in financial inclusion, empowering SMEs, and innovating in payments, Ecobank is positioning itself as a key player in the continent’s economic transformation.

The Africa Financial Summit will offer further opportunities for stakeholders to explore these strategies and chart a course for a robust and inclusive banking sector.