Falling Commodity Prices Ease Inflation Pressures but Threaten Developing Economies’ Growth

Global commodity prices are set to plunge to their lowest point of the decade, the World Bank warns, as slowing economic growth and ample oil supply converge. Prices are projected to drop by 12 percent in 2025 and a further 5 percent in 2026, erasing much of the post–pandemic and Ukraine war-driven boom.

While lower energy and food costs should moderate inflationary pressures—energy prices alone are forecast to fall 17 percent this year to a five-year low—two out of three developing economies risk stalling growth. For the first time since before the pandemic, real commodity prices will slip below their 2015–19 average, exposing exporters to sharply reduced revenues.

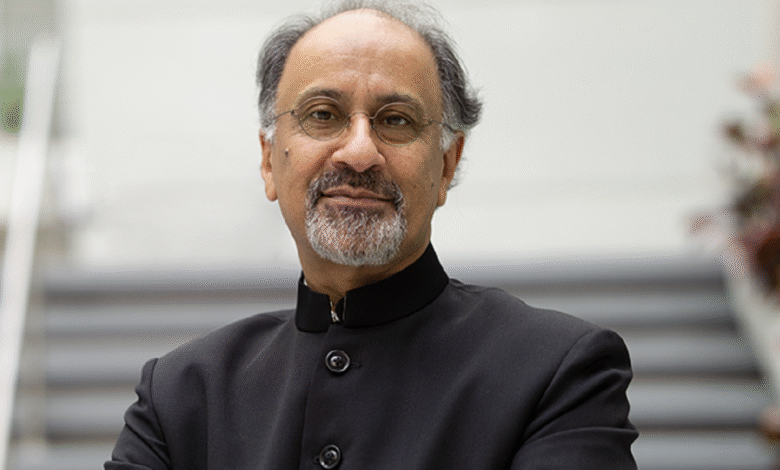

“Higher commodity prices have been a boon for many developing economies two-thirds of which are commodity exporters,” says Indermit Gill, the World Bank Group’s Chief Economist. “But we are now seeing the highest price volatility in more than fifty years. Falling prices and volatile markets demand urgent fiscal discipline, stronger institutions and a more business-friendly environment to attract private capital.”

Energy: Brent crude is expected to average sixty-four dollars per barrel in 2025, down seventeen dollars from 2024, with coal prices tumbling 27 percent. A global oil surplus of 0.7 million barrels per day and growing electric-vehicle adoption—now accounting for over 40 percent of China’s new car sales—are key drivers.

Food: Global food prices will ease seven percent in 2025, yet acute hunger may intensify for 170 million people across 22 vulnerable countries. Lower prices can help humanitarian relief but won’t resolve conflict-driven food insecurity.

Metals and Minerals: Industrial metal prices will weaken further amid trade tensions and China’s property slowdown. By contrast, gold, the classic safe-haven asset, is poised for a new record high in 2025, remaining roughly 150 percent above its pre-pandemic average.

A special focus in the Outlook highlights increasingly sharp boom-and-bust cycles. Since 2020 commodity-price swings have lasted half as long as in previous decades, complicating long-term planning and investment.

“Navigating frequent price shocks will require developing economies to build fiscal space, strengthen institutions and improve investment climates,” argues Ayhan Kose, Deputy Chief Economist. “Governments must shift from short-term reactions to policies that anchor sustainable growth, diversify exports and shield vulnerable populations.”

For businesses and investors, the coming years offer both opportunity and risk. Lower input costs may improve profit margins, but companies reliant on commodity exports must brace for tighter margins and invest in value-adding diversification now to ride out the next cycle.