CIB Ghana Rolls Out Digital Academy and Leadership Programme to Strengthen Banking Sector Resilience

The Chartered Institute of Bankers, Ghana (CIB Ghana) has launched three major initiatives aimed at modernising the country’s banking profession and aligning it with global trends.

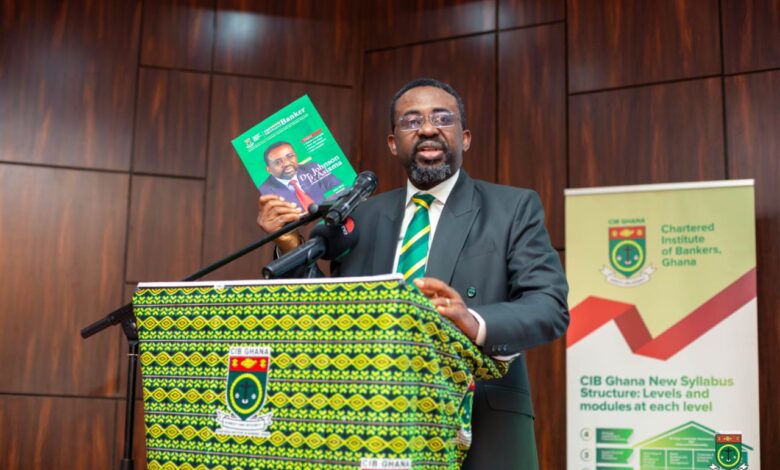

At a high-profile event in Accra attended by Bank of Ghana Governor Dr. Johnson Asiama, the Institute introduced a new Digital Academy, a Branch CEO Programme, and relaunched its flagship publication, The Ghanaian Banker Magazine.

The initiatives reflect CIB Ghana’s strategic push to enhance professionalism, leadership readiness, and digital literacy within Ghana’s evolving financial sector. With increasing regulatory demands, digital disruption, and cybersecurity threats, CIB Ghana says the reforms are essential to future-proof the industry.

“Today’s banker must be digitally fluent, ethically grounded, and strategically agile. These new programmes are designed to build exactly that kind of professional,” said Mr. Robert Dzato, Chief Executive Officer of CIB Ghana.

At the heart of the new strategy is the Digital Academy, an online learning platform offering courses in artificial intelligence, cybersecurity, fintech, and digital banking. The academy provides accessible, self-paced content for bankers seeking to upskill and remain competitive in a tech-driven marketplace.

The Branch CEO Programme, also unveiled, targets branch, regional, and operational managers, offering them a structured pathway to senior leadership and professional certification. Participants will progress through three levels of training, covering core areas such as risk, regulation, and digital transformation. Successful candidates will move closer to attaining the Associate Chartered Banker (ACIB) designation.

In addition, the relaunch of The Ghanaian Banker Magazine aims to foster knowledge-sharing and thought leadership. The redesigned publication will feature sector analysis, commentary from financial experts, and profiles of transformative initiatives within Ghana’s banking ecosystem.

Governor Dr. Johnson Asiama praised the Institute’s efforts, noting they align with the Bank of Ghana’s vision for a robust, ethical, and digitally inclusive banking sector. “These initiatives by CIB Ghana are timely. They support the Bank’s regulatory drive and ensure the industry is positioned to respond to global and local trends,” he said.

Mr. Benjamin Amenumey, President of CIB Ghana, reaffirmed the Institute’s commitment to building a world-class banking profession: “This is more than a launch, it’s a repositioning of banking education and ethics in Ghana.”

With these new tools, CIB Ghana is charting a new course, one where bankers are equipped to thrive in a dynamic financial landscape shaped by innovation, regulation, and public trust.