BoG Tightens Bancassurance Rules, Bars Banks from Selling Insurance to Corporate Clients

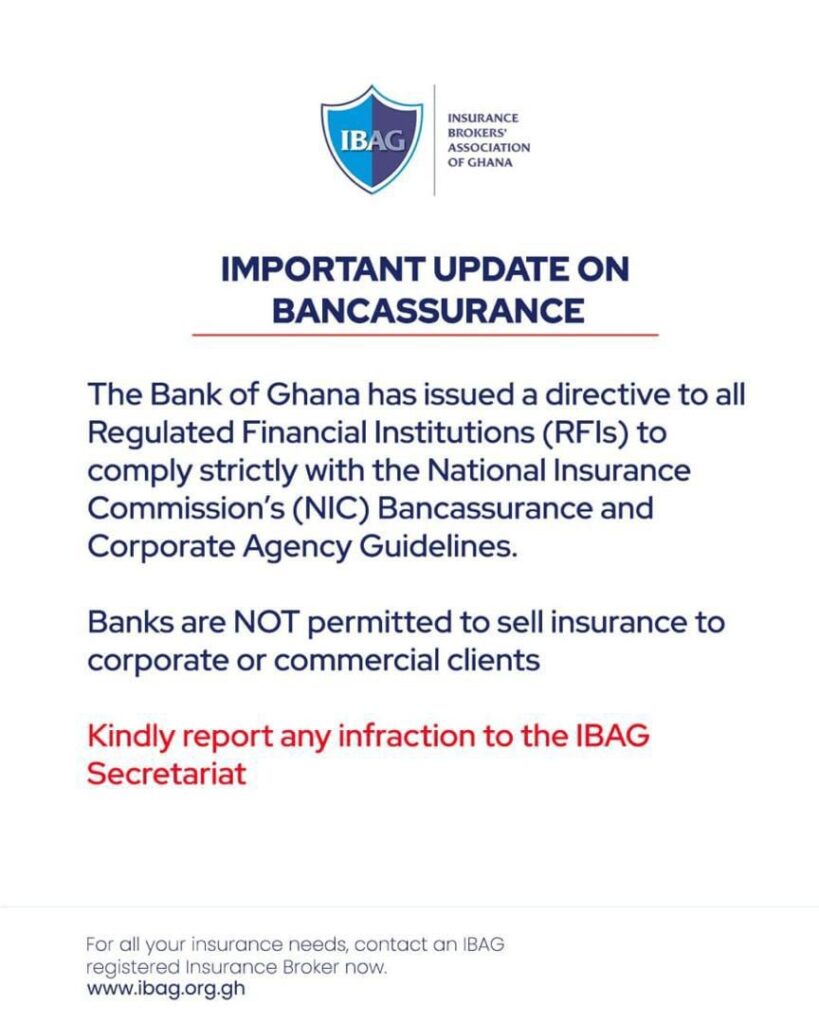

The Bank of Ghana (BoG) has issued a directive requiring all regulated financial institutions (RFIs) to strictly comply with the National Insurance Commission’s (NIC) Bancassurance and Corporate Agency Guidelines, reinforcing oversight in the growing bancassurance market.

Under the new order, banks are prohibited from selling insurance products directly to corporate or commercial clients. Instead, such services must be provided by licensed insurance companies and brokers operating under NIC regulation.

The Insurance Brokers Association of Ghana (IBAG), which announced the directive to its members and the public, has urged stakeholders to report any infractions to its Secretariat.

Protecting Market Integrity

The move is seen as an effort to prevent unfair competition between banks and insurance brokers. While bancassurance the collaboration between banks and insurers has grown rapidly in Ghana, industry players have long raised concerns that banks were overstepping their role by acting as direct insurers, potentially disadvantaging professional brokers and raising conflict of interest issues.

Industry experts note that banks, with their extensive customer databases and branch networks, often enjoy an advantage in cross-selling insurance products. The BoG directive levels the playing field, ensuring that professional intermediaries who are trained to assess client needs and risks are not sidelined.

Implications for Businesses

For corporate and commercial clients, the directive means that insurance policies will need to be sourced directly from licensed insurers or brokers rather than bundled with banking services. This could lead to more tailored insurance solutions, greater transparency, and stronger consumer protection.

Insurance sector players believe the directive could boost broker activity and open up opportunities for innovation in product design and customer engagement. It is also expected to deepen collaboration between banks, insurers, and brokers in ways that respect regulatory boundaries.

Bigger Picture

The directive comes at a time when Ghana’s financial regulators are tightening compliance across the sector, with greater emphasis on governance, accountability, and consumer protection. By aligning with NIC guidelines, the Bank of Ghana is sending a strong signal about its commitment to regulatory harmonization.

The bancassurance market, which has grown steadily over the past decade, is considered a key driver for increasing insurance penetration in Ghana — still under 3% of GDP, one of the lowest in Africa. Ensuring its integrity, experts argue, is crucial if Ghana is to build public trust and expand coverage.