Global Growth Shows Resilience but 2020s Set to Be Weakest Decade Since 1960s, World Bank Warns

The global economy is proving more resilient than previously expected in the face of ongoing trade frictions and policy uncertainty, but remains on track for its slowest growth decade in more than 60 years, the World Bank said in its latest Global Economic Prospects report.

Global output is forecast to remain broadly stable over the next two years, easing to 2.6% in 2026 before edging up to 2.7% in 2027 both upward revisions from the Bank’s June projections. The improved outlook is largely driven by stronger-than-anticipated performance in major economies, particularly the United States, which accounts for nearly two-thirds of the upward revision to the 2026 forecast.

Despite the near-term resilience, the World Bank cautioned that the 2020s are shaping up to be the weakest decade for global growth since the 1960s, with lasting implications for incomes and inequality. By the end of 2025, per capita incomes in almost all advanced economies had surpassed pre-pandemic levels, while roughly a quarter of developing economies remained poorer than in 2019.

Growth in 2025 was underpinned by a front-loading of global trade ahead of expected policy changes and swift reconfiguration of supply chains. These supports are expected to fade in 2026 as trade activity cools and domestic demand softens. Still, easier global financial conditions and fiscal expansion in several large economies are expected to cushion the slowdown.

Global inflation is projected to ease to 2.6% in 2026, reflecting softer labour markets and lower energy prices. Growth is expected to strengthen modestly in 2027 as trade patterns adjust and policy uncertainty diminishes.

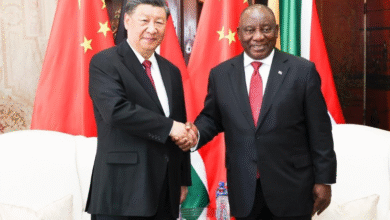

“With each passing year, the global economy has become less capable of generating growth and seemingly more resilient to policy uncertainty,” said Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice President for Development Economics. He warned, however, that such a divergence cannot persist indefinitely without straining public finances and credit markets.

Gill noted that the global economy is now expected to grow more slowly than it did in the turbulent 1990s, while carrying record levels of public and private debt. To avoid stagnation and rising unemployment, he urged governments to liberalise private investment and trade, curb public consumption, and scale up investment in technology and education.

In developing economies, growth is projected to slow to 4% in 2026 from 4.2% in 2025, before picking up slightly to 4.1% in 2027 as trade tensions ease, commodity prices stabilise and investment flows recover. Low-income countries are expected to grow faster, averaging 5.6% over 2026–27, supported by firmer domestic demand, recovering exports and moderating inflation.

Even so, income gaps are expected to persist. Per capita income growth in developing economies is projected at 3% in 2026—about one percentage point below its 2000–2019 average. At that pace, per capita incomes in developing economies would reach only 12% of those in advanced economies.

The outlook intensifies pressure on job creation, particularly in developing countries, where an estimated 1.2 billion young people will enter the labour force over the next decade. The World Bank said addressing the challenge will require a coordinated policy push to strengthen physical, digital and human capital, improve regulatory certainty and policy credibility, and mobilise private investment at scale.

Fiscal sustainability is also emerging as a critical concern, weakened by overlapping global shocks, rising development needs and higher debt-servicing costs. A special-focus chapter of the report underscores the role of fiscal rules—such as caps on deficits, debt or spending in restoring public finance discipline.

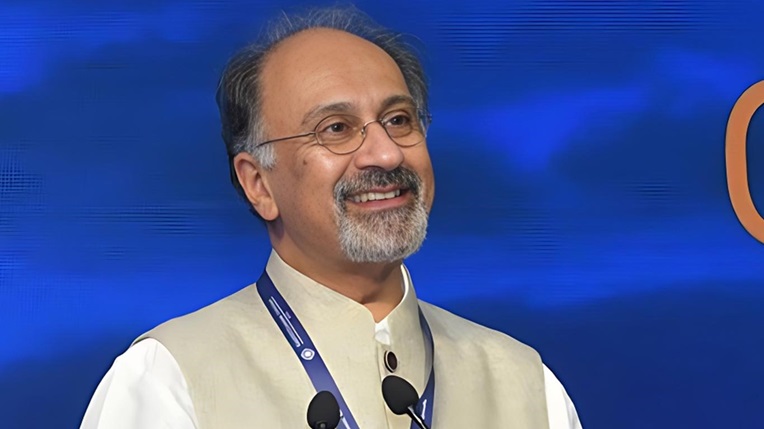

“With public debt in emerging and developing economies at its highest level in more than half a century, restoring fiscal credibility has become an urgent priority,” said M. Ayhan Kose, the World Bank Group’s Deputy Chief Economist.

More than half of developing economies now operate at least one fiscal rule. Those that do typically record an improvement in budget balances of about 1.4 percentage points of GDP within five years, the report said, though the long-term benefits depend on institutional strength, credible enforcement and sustained political commitment.