BoG Backs SME Growth with Bold Reforms

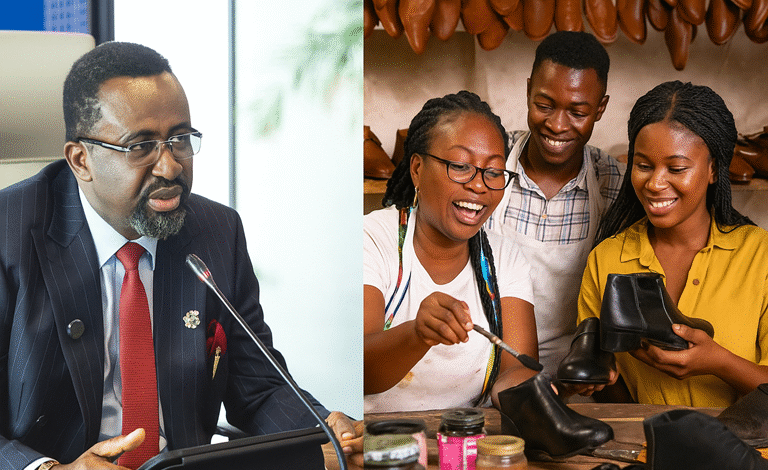

The Governor of the Bank of Ghana, Dr Johnson Asiama, has outlined key measures the central bank is implementing to create a stronger financial foundation that enables banks to better support small and medium enterprises (SMEs).

He spoke at a workshop on Supporting SMEs to Sustainable Global Value Chains, organized by the Ghana Association of Banks (GAB) in collaboration with Afreximbank, the Trade and Development Bank (TDB), and the African Development Bank (AfDB).

Dr Asiama noted that while banks must innovate to improve SME financing, the Bank of Ghana has been deliberate in building the enabling environment for such innovation to succeed.

Stronger Banking Sector

He pointed to recent financial sector reforms aimed at strengthening bank capital, improving supervisory frameworks, and enhancing risk management. Though the reforms were challenging, he said they have made Ghana’s banking system more resilient and better positioned to absorb shocks. This resilience, he explained, gives banks the confidence to take calculated risks in lending to SMEs.

Driving Innovation and Digital Finance

Highlighting the role of technology, the Governor said the Bank of Ghana has built regulatory frameworks to support mobile money, interoperable payments, and e-wallet services. These platforms, he stressed, are more than just conveniences, as they allow SMEs to transact, build track records, and access formal financing. He added that the central bank is now designing guidelines for open banking and virtual asset service providers to ensure Ghana’s financial system remains modern, secure, and innovation-friendly.

Improved Credit Infrastructure

To address long-standing barriers to SME lending, Dr Asiama said the central bank has strengthened the credit information ecosystem through active credit bureaus, a functional Collateral Registry, and reforms aimed at reducing non-performing loans. These tools, he explained, give banks the ability to lend based on risk profiles rather than collateral alone.

Ensuring Stability and Collaboration

The Governor also referenced the establishment of the Financial Stability Council, a collaborative platform between the Bank of Ghana, government, and other regulators to monitor risks and coordinate responses. “When stability is assured, banks can confidently extend their intermediation role to SMEs and the wider economy,” he said.

Pushing Green Finance

Dr Asiama stressed the importance of aligning with global trends in climate-conscious finance. He said Ghanaian banks must integrate sustainability into their lending practices through green loans, credit guarantees, and tailored advisory services. This, he added, will help SMEs adopt energy-efficient technologies, meet international certifications, and integrate into sustainable global value chains.

“These measures reflect our conviction that a strong, modern, and inclusive banking system is indispensable for SME growth,” Dr Asiama concluded.