Ghana’s Construction Inflation Slows Sharply, Shifting Cost Pressures to Labour

Ghana’s construction sector is experiencing its strongest easing in cost pressures in nearly a year, with new data showing a sustained slowdown in building inflation even as labour costs remain stubbornly high.

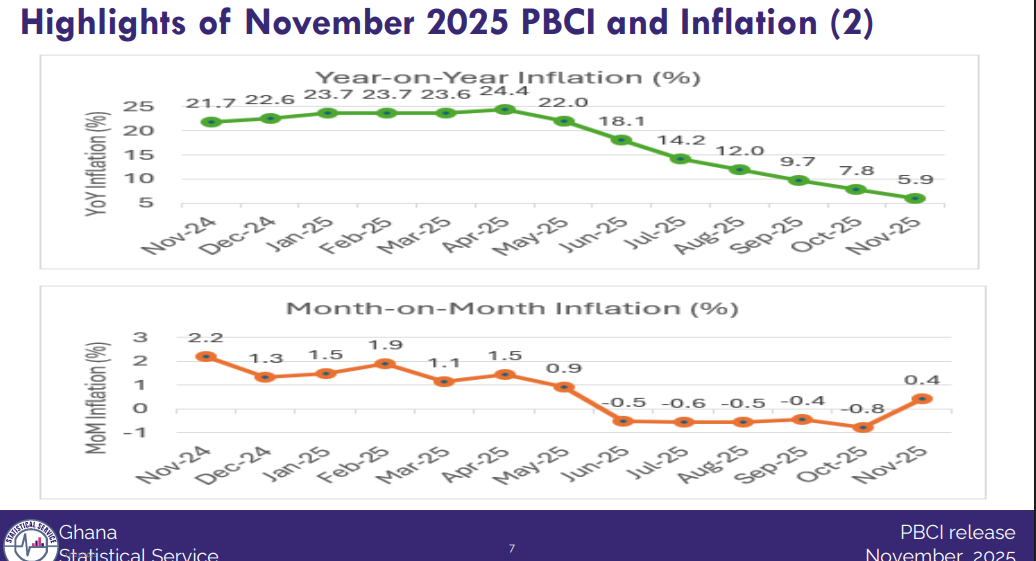

The latest Prime Building Cost Index (PBCI) released by the Ghana Statistical Service shows that year-on-year construction inflation fell to 5.9 percent in November 2025, extending a seven-month consecutive decline from the peak recorded at the end of 2024.

The data suggest that the sharp inflation shocks that battered the construction industry over the past two years are gradually unwinding, driven largely by stabilising material prices and easing plant costs.

While overall building input prices rose marginally by 0.4 percent month-on-month, the broader trend points to cooling cost pressures, particularly on materials, which account for more than three-quarters of total construction costs.

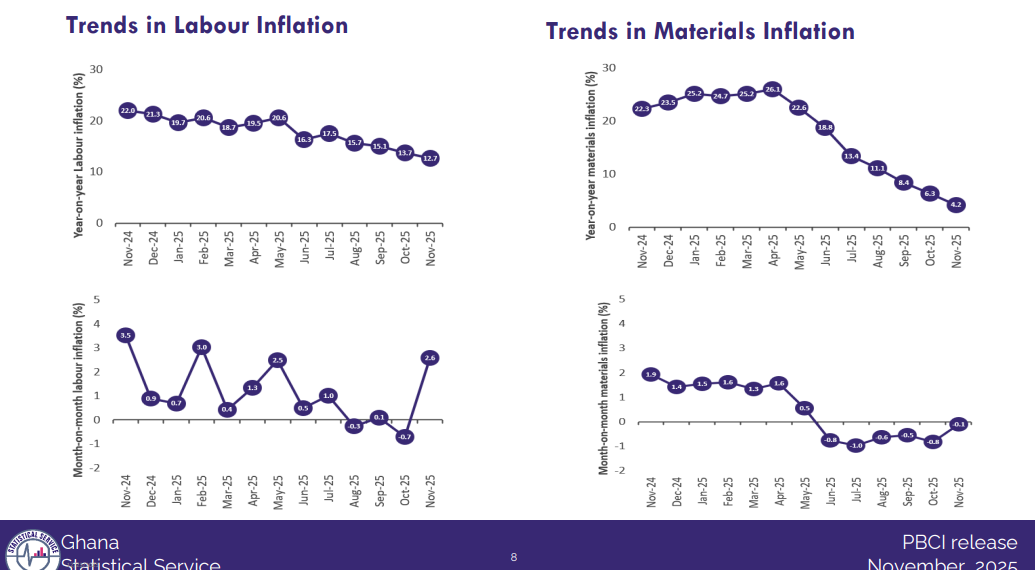

Materials inflation drops, led by cement and reinforcement

Materials inflation eased significantly to 4.2 percent year-on-year, down from 6.3 percent in October, with prices declining slightly on a month-on-month basis. Cement and reinforcement recorded some of the steepest disinflation, posting negative annual inflation rates, a signal of improving supply conditions and easing import pressures.

Steel, which remains the single largest cost driver in construction, also saw a notable slowdown in inflation, reinforcing the broader moderation trend across core building inputs.

This easing in material prices has been the dominant factor behind the sustained decline in overall construction inflation, offering relief to developers and households who had postponed projects due to escalating costs.

Labour costs remain the main pressure point

Despite the overall slowdown, labour inflation continues to exert upward pressure on construction costs. Year-on-year labour inflation stood at 12.7 percent in November, only marginally lower than the previous month, while labour prices rose sharply on a month-on-month basis.

Both skilled and unskilled labour recorded double-digit inflation, with unskilled labour costs accelerating faster in the short term. The data suggest that while imported cost pressures are easing, domestic labour constraints likely driven by skills shortages and rising wage expectations remain unresolved.

Labour now accounts for over a quarter of total inflationary contribution within the PBCI, underscoring its growing importance as the key cost risk facing the construction sector.

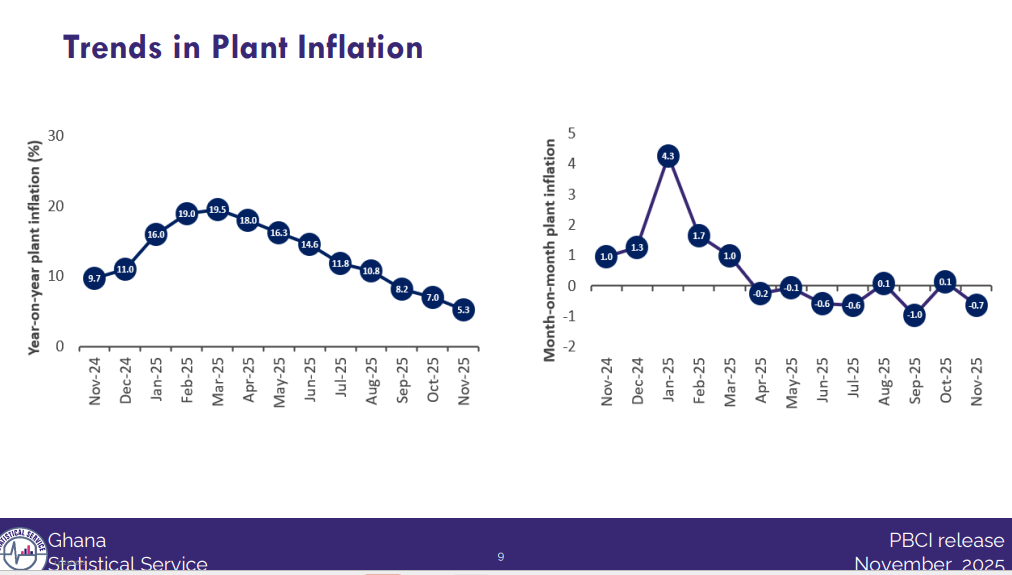

Plant and equipment costs slow further

Inflation for plant and equipment also continued to decelerate, falling to 5.3 percent year-on-year, with prices declining month-on-month. While equipment still recorded the highest inflation among sub-groups, its contribution to overall cost increases was relatively modest due to its smaller weight in the index.

This trend reflects easing global equipment prices and improved availability, contrasting sharply with conditions seen during the peak of supply chain disruptions.

What the trends mean for the economy

The sustained decline in building cost inflation signals improving macroeconomic conditions and offers a window of opportunity for both public and private sector investment.

With material prices stabilising and plant costs easing, developers and households are better positioned to resume stalled projects, while government could benefit from lower procurement costs as it advances infrastructure programmes.

However, the persistence of high labour inflation highlights a structural challenge. Without targeted skills development and productivity improvements, labour costs could emerge as the next major constraint on construction sector growth.

Overall, the November data point to a construction market transitioning out of crisis, but not yet free of risk—one where inflation is cooling, but cost pressures are becoming increasingly domestic rather than imported.