BoG moves to sanitise forex market

The Bank of Ghana (BoG) has announced measures to regulate and sanitise the foreign exchange market, improve documentation requirements, reduce demand pressures, and clamp down on illegal operators and unauthorised advertising

The regulator in collaboration with the Ghana Association of Banks has streamlined documentation requirements for foreign payments, reducing incentives for informal market activities.

To address high demand pressures, the BoG has directly absorbed foreign exchange needs of select corporate institutions, resulting in reduced pipeline demand from commercial banks.

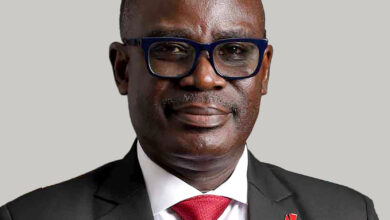

Addressing journalists at a press briefing in Accra on Monday, Governor of the Bank , Dr Ernest Addison said “the Bank is aware of illegal operators in the market and is working with the Financial Intelligence Centre to sanitise the foreign exchange market.”

He warned that “foreign exchange bureaux will face increased monitoring to ensure compliance with regulatory frameworks. All bureaux advertising rates outside their premises or on social media must cease immediately. A task force has been established to monitor bureaux and ensure compliance.”

Dr Addison explained that the exchange rate pressures witnessed in recent weeks reflecedt a weakening of the current account surplus, due to higher import demand and lower export revenue, especially a sharp fall in cocoa export earnings.

“The foreign exchange market pressures also reflect robust public spending on IPP arrears payment, and capital expenditure outlays. There are also indications of increased pressures from importers diverting foreign exchange demand requirements into informal markets, increasing speculative demand for foreign exchange,” he added.

The BoG also urged caution on pronouncements that weaken confidence in the local economy, particularly in this election year.

Dr Adison announced that the Bank’s Monetary Policy Committee had kept the policy rate at 29 percent. Dr. Ernest Addison noted that the committee took the decision to help keep inflation stable.

He explained that the latest forecast shows a slightly elevated inflation profile on account of recent exchange rate pressures and adjustments in transportation fares.

According to Dr. Addison, the projections showed that inflation will remain within the monetary policy consultation clause of 13-17 percent at the end of the year.

“These forecasts are contingent on sustaining the tight monetary policy stance, including aggressive liquidity management operations. Given these considerations, the committee decided to maintain the Monetary Policy Rate at 29.0 percent”, he said.

On the macroeconomic front, Dr Addison noted that policies aligned with the IMF-supported programme, but emphasized the need to prevent currency depreciation from influencing pricing behaviour and inflation expectations.

Ghana’s strong reserve build-up, disinflation process, fiscal policy consolidation, positive current account balances, and progress on external debt restructuring had created buffers to support the exchange rate.