GRA Enforces 25% Tax on Profits from Sale of Assets

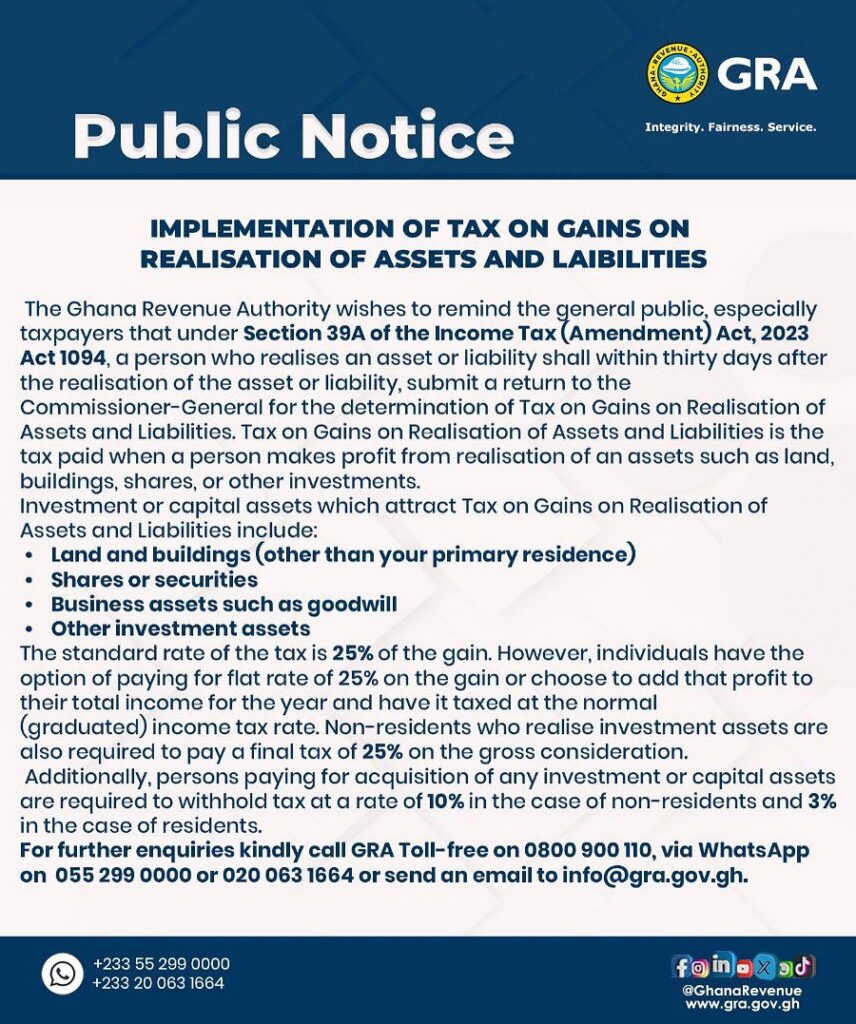

The Ghana Revenue Authority (GRA) has reminded citizens and businesses that profits made from selling assets such as land, buildings, shares, or other investments will now attract a 25% tax, in line with the 2023 Income Tax (Amendment) Act.

The law, under Section 39A, requires anyone who makes such a gain to file a return with the Commissioner-General within 30 days after the sale. The measure is aimed at widening the tax net and boosting domestic revenue as government continues efforts to stabilise public finances.

The new rules cover a wide range of assets, including:

-

Land and houses, except the seller’s primary residence;

-

Shares or securities on the stock market;

-

Business assets such as goodwill;

-

Other investment properties.

The GRA explained that the standard rate is 25% of the gain. However, individuals may choose to add the profit to their annual income and have it taxed under the normal graduated income tax system, which could be more or less favourable depending on their earnings.

For non-residents, the 25% levy is applied directly on the gross proceeds, while residents and non-residents involved in property or asset transactions must also account for withholding tax — 3% for residents and 10% for non-residents.

The authority said the rule is designed to bring fairness into the tax system. For years, salaried workers have borne the bulk of Ghana’s tax burden, while many people who profit from land sales or business disposals have paid little or nothing.

Why it matters

The GRA pointed out that Ghana relies heavily on taxes to fund schools, hospitals, roads, and public services. In villages and towns, this translates into better classrooms, health posts, and feeder roads. With property values rising, especially in urban areas, the government sees taxing these gains as a fair way to capture revenue from wealthier sections of society.

To make it relatable: If a farmer in a village sells a piece of land for GHS 50,000 and makes a profit of GHS 20,000 on the deal, she would be expected to pay GHS 5,000 (25% of the profit) to the state. If she sells her family’s main home, however, no tax would apply.

The GRA urged the public to comply and seek clarification where needed. Failure to file within 30 days could attract penalties.

The measure comes as the government pushes harder to raise domestic revenue after entering a $3 billion IMF programme last year. Analysts say while such taxes can improve fairness, the challenge will be enforcement, particularly in areas where most land and asset sales are undocumented.